(CLICK TO ENLARGE) This is actually a 401k for a young person. She works for a small firm. Because it has less than 100 employees,, it can offer what is called a self-directed simple IRA. For the simple IRA the company is required to make a contribution. Thus, the portfolio manager knows when money is coming in and approximately how much. In this particular box, accounts can be combined--obviously important in getting an holistic view of assets.

(CLICK TO ENLARGE) This is actually a 401k for a young person. She works for a small firm. Because it has less than 100 employees,, it can offer what is called a self-directed simple IRA. For the simple IRA the company is required to make a contribution. Thus, the portfolio manager knows when money is coming in and approximately how much. In this particular box, accounts can be combined--obviously important in getting an holistic view of assets.Click "Edit" and then "View/Edit Portfolio." This brings you to a list of the holdings in the portfolio: (this is useful for later)

( CLICK TO ENLARGE) As you can see, the holdings are low cost, low turnover exchange traded funds. The portfolio is well diversified and participating in many markets. ,If individual securities are your style you would probably have many more holdings listed here .

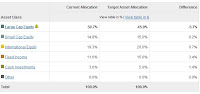

( CLICK TO ENLARGE) As you can see, the holdings are low cost, low turnover exchange traded funds. The portfolio is well diversified and participating in many markets. ,If individual securities are your style you would probably have many more holdings listed here .Now we are set up to analyze the portfolio. Click "analyze portfolio" and "View Table in %":

(CLICK TO ENLARGE)

(CLICK TO ENLARGE)The right-hand column indicates changes that need to be made to bring portfolio into conformance. "Large Cap Equity" needs to be reduced and "Fixed Income" needs to be increased. "Cash Investments" can also be brought down to zero.

,

Next we'll look at specific trades that will accomplish the rebalancing.

If you can't wait, figure them out yourself using the securities held in the portfolio.

It hopefully, goes without saying that all of this takes considerably longer to explain and go over the first time than it actually takes. This is a 15-minutes-a-week operation once the portfolio is set up and you've been through it a couple of times.