Yep, fired again. Actually, this way of putting it came up as a result of an interview of me by Millionaire Teacher author Andrew Hallam. As Andrew and I discussed, a major part of my practice is to get clients to the point where they can take over their investment management. It's not for everybody. It's like taxes. Some people prefer to do their own taxes, some not. With investments, some people will let their emotions run their investments and, in the end, do more harm than good, get stressed out, and let volatile markets make them miserable. Others just don't want to be bothered and value the comfort of a professional doing the nitty gritty work. I respect that and welcome those clients as well.

But for some, we go in with the objective of the client taking over the reins one day. I am proud of this service for two reasons. First, I don't know of anyone else who really does it on a 1-to-1 basis. Secondly, taking over the reins can really make a huge difference in the size of the nest egg as people approach retirement and go through retirement.

This recent firing involved a 9-month collaboration. The client is a widowed middle school teacher. As is typical, I moved her from commissioned brokers who put her into expensive load funds to low cost well-diversified funds at Charles Schwab. Thus, she moved from being charged somewhere between 1.5% and 2.5% of assets under management to funds that charge between .08% and .30%. My fee added .4% *.75 or .3% over the 9-month period.

Her account, consisting of 3 funds, totaled approximately $400,000. Paying brokers between 1.5% and 2.5% amounted to approximately $6,000 - $10,000/year. Throw in sloppy tax efficiency management and poor performance, which she was experiencing, and all I can say is ouch!!!

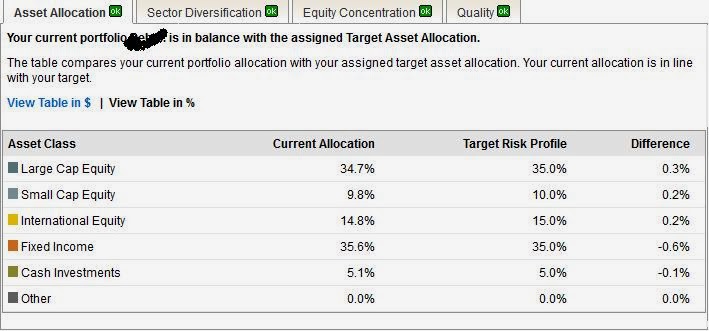

Today, she understands the well-defined asset allocation model that fits her risk tolerance, as shown here:

|

| Source: Charles Schwab |

She has learned to use this table every several months. She now knows the funds for each asset class and how to figure out how many shares to buy or sell to rebalance. She knows how to place the trades online; she knows the difference between bid-ask and how to put a limit trade in.

As time goes by, she knows how to monitor performance as shown in the following table:

|

| Source: Charles Schwab |

Disclosure: Her out performance is not indicative of typical performance. Moving from mutual funds to ETFs in a rising market and putting her cash holdings to work in the rising market produced the abnormal returns. She understands that, over the long term, the objective is to perform close to the benchmark model return.

Many times potential clients come to me puzzled, wanting to know why their accounts are not higher given that the market has moved higher over the last several years. Well, the answer is simple. What has moved higher is their advisor's account at the expense of theirs.

The real payoff for this client will be in a few years when she retires and rolls over her 403(b). At that point, she will be able to manage all her assets efficiently in line with a well-defined asset allocation model.

Although she fired me, she knows that I am an email or phone call away for any questions she has going forward.

Disclosure: This post is for educational purposes. Individuals should do their own research before making investment decisions. The Schwab charts come with disclosure statements that should be read before utilizing. They are used here for illustrative purposes. Other brokers provide similar investment tools.

Rare instance where getting fired can be liberating! Good job Robert!

ReplyDelete